When looking at POS solutions, it’s important to review contracts carefully. This ensures that the terms and costs fit your current and future business needs.

In this article, we explore elements to be aware of when you’re about to sign a POS system contract. Retailers can use these tips to get maximum value and avoid common issues.

A few of the key areas to look at when evaluating POS contracts include the following:

- Specifying hardware and software needs upfront

- Defining implementation and support details clearly

- Ensuring cost transparency for all fees

- Establishing data security and ownership terms

- Outlining the contract’s duration and termination policies

Following these guidelines helps business owners secure a POS agreement suited to their unique needs. Read on to learn more.

Hardware and Software Requirements

Retailers should pay close attention to the hardware and software requirements specifications when negotiating POS system contracts. The hardware aspect of a POS system typically includes components such as terminals, barcode scanners, receipt printers, cash drawers, and card readers. The contract must specify the make and model of each hardware component, ensuring they are up-to-date and compatible with current industry standards.

Additionally, retailers should expect the contract to outline the durability and maintenance support for the hardware, as these factors directly impact the system’s reliability and longevity. On the software side, a comprehensive POS system contract should clearly define the software’s features and capabilities.

This includes the user interface, inventory management, sales reporting, customer relationship management (CRM), and integration capabilities with other systems, such as eCommerce platforms and accounting software. Retailers should look for software that offers real-time data analytics, ease of use, and scalability to adapt to business growth. Moreover, the contract should cover software updates, support, and training to ensure the POS system remains efficient and secure.

Implementation and Deployment

Make sure the agreement thoroughly details the installation and setup process when negotiating POS system contracts. The contract should specify what aspects of the installation the POS provider will handle, such as hardware setup, software installation, and system integration, and what responsibilities fall on the retailer.

Moreover, the contract should cover training for staff on how to use the new system, including the schedule and format of these training sessions. Retailers should expect detailed documentation on the system’s features and troubleshooting procedures.

It’s also crucial for the contract to address post-installation support, outlining the scope of ongoing technical support and maintenance services provided by the POS vendor.

Maintenance and Support

Here are crucial elements that should be included and clarified in the contract:

Training

- Initial Training: The contract should specify the extent of initial training provided to staff. This includes hands-on training for daily operations, handling common issues, and understanding the software interface.

- Advanced Training: Advanced training might be necessary for more complex features or managerial staff.

- Training Materials: Access to training manuals, online tutorials, or video guides should be included.

- Ongoing Training: As updates and new features are added to the POS system, ongoing training should be provided to ensure staff are up to date.

Ongoing support

- Availability: The contract should clearly state the hours support is available. 24/7 support is ideal, especially for businesses outside of standard business hours.

- Response Time: The maximum response time for support requests should be specified. This can vary based on the severity of the issue (e.g., immediate response to critical system failures).

- Support Channels: Outline the available support channels (phone, email, live chat, etc.) and any specific protocols for urgent issues.

Maintenance

- Regular Updates: Ensure the contract includes regular software updates for new features, security patches, and bug fixes.

- Hardware Maintenance: The contract should detail the maintenance services provided, including frequency and costs if the POS system includes hardware.

- System Backups: Detail data backup frequency and recovery services in case of system failure.

- Description of Responsibilities: Outline both the retailer and vendor responsibilities.

Fees and Payment Terms

Upfront costs

This includes the initial cost of purchasing or leasing the POS system. Retailers should understand whether the pricing is a one-time fee or if there are installment plans available. It’s important to clarify what is included in this initial cost – for instance, does it cover hardware like terminals, scanners, printers, and cash drawers?

Recurring charges

These are ongoing costs associated with the use of the POS system. This could include monthly or annual fees for software licensing, support services, or cloud-based services. Retailers should clarify if these charges are fixed or if they can vary based on usage, number of terminals, or other factors.

Payment schedules

The contract should clearly state when payments are due. This could be monthly, quarterly, or annually. Understanding the payment schedule is crucial for budgeting and financial planning.

Additional costs

Retailers should be aware of any additional costs that may arise:

- Installation fees: The cost of setting up the POS system may vary depending on the system’s complexity and the retail space’s specific needs.

- Maintenance fees: Ongoing costs for maintaining the system. This could be a regular service fee or charges for specific maintenance requests.

- Upgrade costs: Additional costs might be involved if the system requires software or hardware upgrades. Understanding how often upgrades are needed and their estimated costs is essential.

- Training costs: Some POS systems may require staff training, which could incur additional charges.

Service level agreements (SLAs)

While not directly a pricing term, SLAs can have financial implications. They define the expected level of service (like uptime support response times) and may include financial penalties or credits for the vendor not meeting these levels.

Data Ownership and Security

When negotiating POS system contracts, retailers should pay close attention to data ownership and security clauses to protect customer information. These sections should specify that the retailer retains ownership over all transaction and customer data the POS system collects.

The contract should also detail the POS provider’s security measures, including encryption protocols, access controls, breach notification procedures, and compliance with data protection regulations like PCI-DSS and GDPR. Specifically, retailers should expect guarantees that customer credit card and personal information will be transmitted and stored securely, with limited employee access.

Asking POS providers to explain and document their security policies is critical when negotiating POS contracts, as retailers are responsible for safeguarding sensitive customer data. Defining data ownership and security expectations upfront will help mitigate risk when deploying new POS technology.

Term and Termination

Notice period

Termination clauses typically specify a notice period, which is the time one party must give the other before terminating the contract. This period can vary, but common durations are 30, 60, or 90 days. The notice period allows both parties to prepare for the end of the contract, including finding alternative solutions or resolving outstanding issues.

Termination for cause

The contract should clearly define what constitutes a breach or a failure to meet obligations, allowing for termination for cause. This could include failure to deliver services as promised, repeated downtime, security breaches, or non-compliance with agreed-upon standards.

Termination for convenience

Some contracts include a clause that allows either party to terminate the agreement for any reason. This is known as termination for convenience. While this offers flexibility, it may come with penalties or fees to compensate the other party for the sudden termination.

Penalties and fees

There may be penalties or fees if the contract is terminated early, especially for convenience. These should be clearly outlined in the agreement. For instance, the retailer might be required to pay a percentage of the remaining contract value or a flat fee.

Handling of prepaid services

If the retailer has paid for services in advance, the termination clause should address how these prepayments will be handled. For instance, will there be a prorated refund, or is the prepaid amount non-refundable?

Data handling and transition

Particularly important in POS system contracts is the handling of data upon termination. The contract should specify how customer and transaction data will be handled, transferred, or deleted at the end of the contract. This is crucial for maintaining data security and privacy.

Equipment return or purchase

If the POS system includes leased or loaned equipment, the termination clause should state the terms for returning this equipment. Alternatively, it might offer terms for purchasing the equipment at the end of the contract.

Post-termination obligations

Some obligations, such as non-disclosure agreements or post-termination support, may persist after the contract ends. These should be clearly outlined.

Dispute resolution

The clause should also include provisions for resolving any disputes arising from the contract’s termination, including arbitration or legal proceedings, and which jurisdiction’s laws will apply.

Renewal terms

Sometimes, the termination clause is linked with renewal terms, outlining how and when the contract can be renewed and under what conditions it will automatically renew or terminate.

What Makes Combase USA Different?

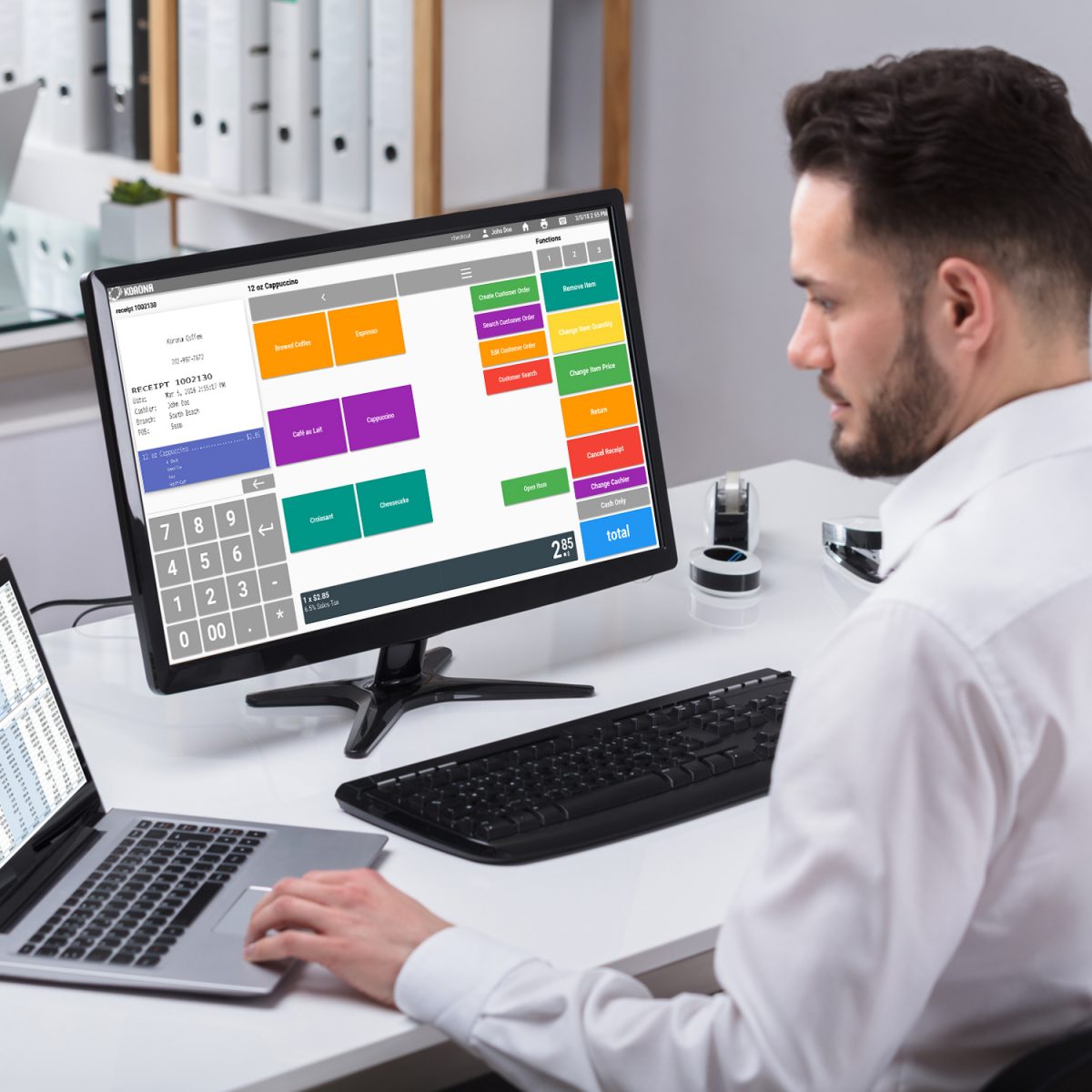

As a business owner, choosing the right POS system is crucial for efficiently running your stores and protecting sensitive customer data. Business owners seeking a reliable and versatile point of sale system with transparent pricing and award-winning customer support should consider KORONA POS by COMBASE USA.

The solution stands out for its exceptional adaptability and user-friendly features, tailored to meet the unique needs of various industries, including retail, quick-service restaurants, and admissions. One of the most compelling aspects of KORONA POS is its unlimited free trial, allowing business owners to thoroughly explore its functionalities without any time constraints or financial commitments.

This is complemented by a personalized product demo, ensuring that each business can see firsthand how KORONA POS can be customized to their specific operational needs. Furthermore, COMBASE USA provides a 60-day money-back guarantee on all hardware and software.

Unlike other POS providers, COMBASE USA does not lock you into long contracts or force you to use only one credit card processor. The software integrates securely with all major payment processors, so you can benefit from top-tier POS technology without worrying about long-term financial commitments. And KORONA POS offers transparent, flat-rate pricing – no surprise fees based on transaction volume or number of terminals.

Additionally, COMBASE USA provides 24/7 in-house support, ensuring any issues are promptly and efficiently resolved. This comprehensive support, combined with the system’s custom features designed for specific industries, makes it an ideal choice for businesses looking for a robust, adaptable, and supportive POS solution. Sign up now for a personalized demo to learn more about KORONA POS. Click here to get started.

FAQs Negotiating POS System Contracts/Agreements

1. What is a POS contract?

A POS (point of sale) contract is an agreement between a business and a POS system provider. It outlines the terms and conditions for using the POS system, including hardware, software, services, support, payment terms, and any other obligations or rights of the parties involved.

2. What does a POS system include?

A POS system typically includes hardware components like a computer or tablet, a cash drawer, a receipt printer, a barcode scanner, and a card reader. It also includes software for processing transactions, managing inventory, tracking sales, and generating reports.

3. What are POS system requirements?

POS system requirements vary depending on the business needs but generally include hardware compatibility (like a computer or tablet), a stable internet connection, sufficient storage and processing power for the software, peripheral device support (like printers and scanners), and security features to protect transaction data.

4. What are the three types of POS?

There are three main types of POS systems:

- Traditional POS: A stationary retail or hospitality system often features robust hardware and software

- Mobile POS (mPOS): Utilizes mobile devices like smartphones or tablets, ideal for businesses that require mobility

- Cloud-Based POS: Systems that store data on remote servers and can be accessed over the internet, offering flexibility and often subscription-based pricing

Recent Comments